Financial discipline is one of the most overlooked yet powerful habits when it comes to managing money effectively. Many people earn well but still struggle with savings, debt, and financial stress because they lack consistent money control. Understanding financial discipline and learning how to practice it can completely change how you handle income, expenses, and long-term goals.

Financial discipline is not about avoiding enjoyment or living with constant restrictions. It is about developing control, clarity, and confidence around money decisions. When practiced correctly, financial discipline becomes a supportive system rather than a burden.

Why Financial Discipline Is Important in Life

Financial discipline plays a major role in creating stability and reducing uncertainty. Without it, money decisions are often driven by impulse, pressure, or short-term emotions.

Financial discipline is important because it helps you:

Control unnecessary spending

Maintain saving consistency

Avoid financial stress

Prepare for emergencies

Make smart financial decisions

People with strong financial discipline experience fewer money-related worries and are better prepared for life changes. This discipline creates a sense of security that impacts both personal and professional life.

How Financial Discipline Builds Long-Term Wealth

Long-term wealth is rarely built through sudden income jumps. It is built through steady habits practiced over time. Financial discipline ensures that good money behavior continues regardless of income level.

Financial discipline supports wealth creation by encouraging:

Consistent saving habits

Disciplined spending choices

Risk-aware spending

Long-term financial planning

Financial independence habits

When financial discipline becomes part of daily life, wealth building strategies work more effectively and sustainably.

How to Develop Financial Discipline Step by Step

Developing financial discipline does not require drastic changes overnight. Small, consistent actions create lasting results.

Steps to build financial discipline include:

Tracking expenses regularly

Setting clear financial goals

Creating spending limits

Practicing money accountability

Reviewing financial behavior monthly

Learning money management habits gradually leads to stronger financial responsibility and better decision-making over time.

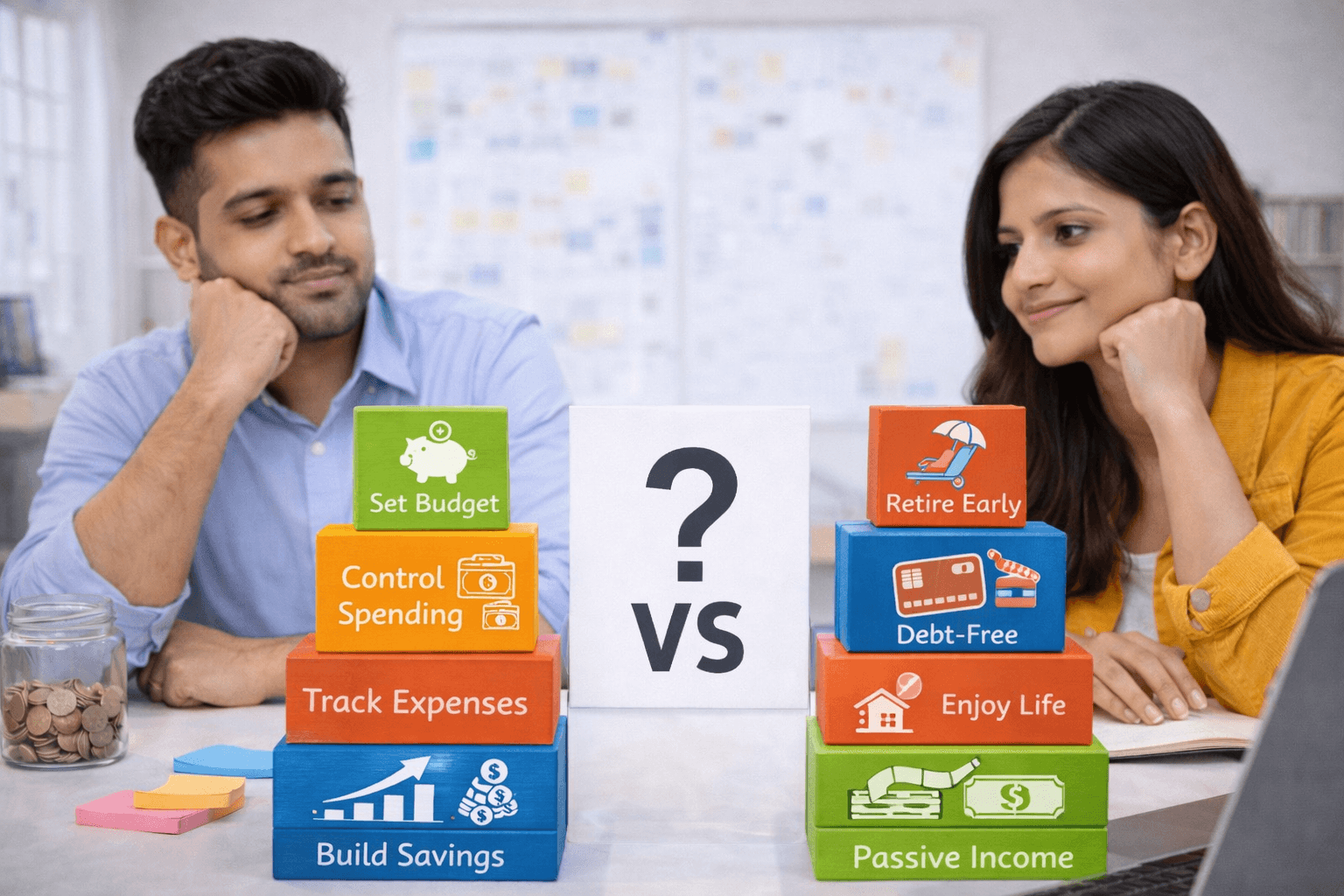

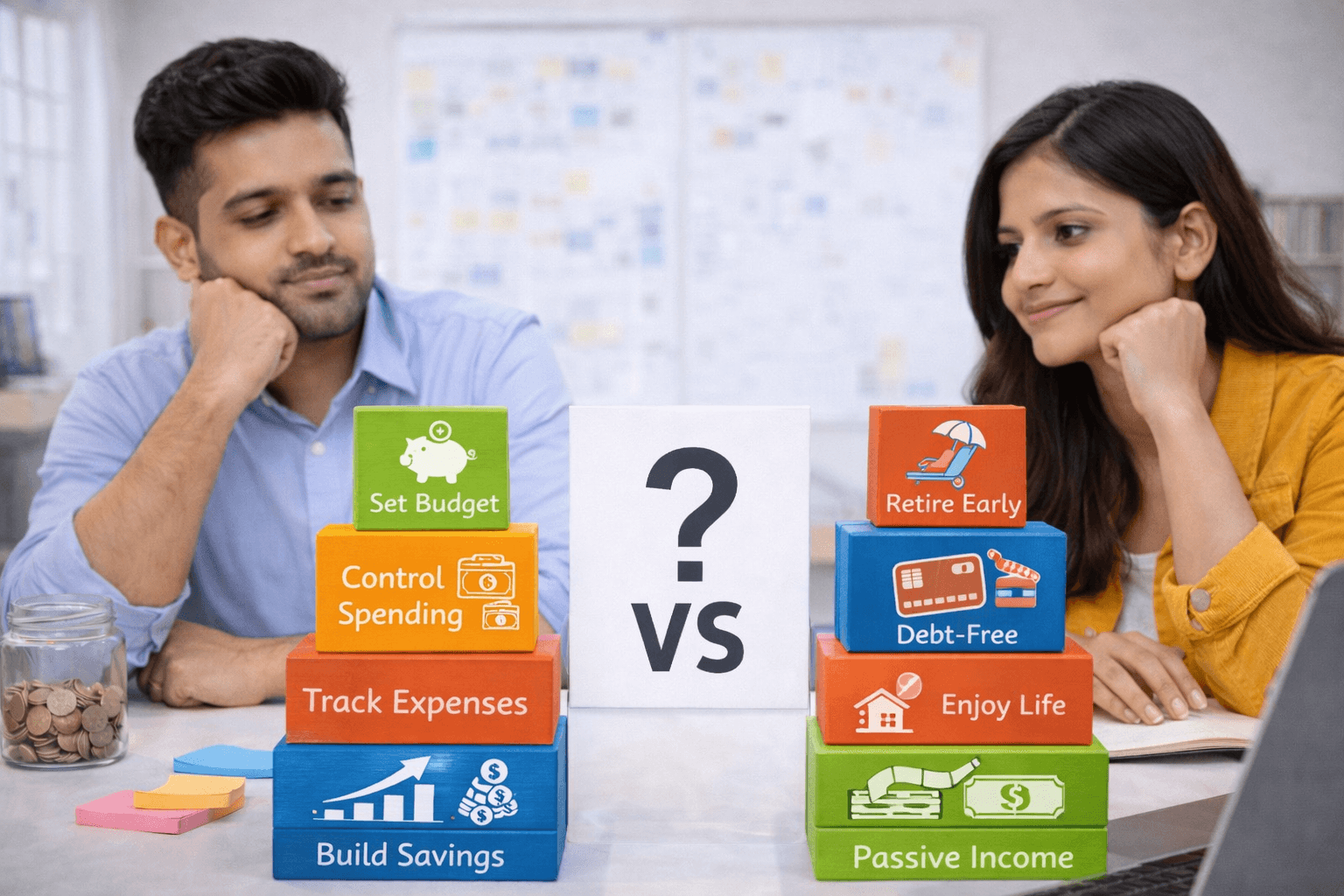

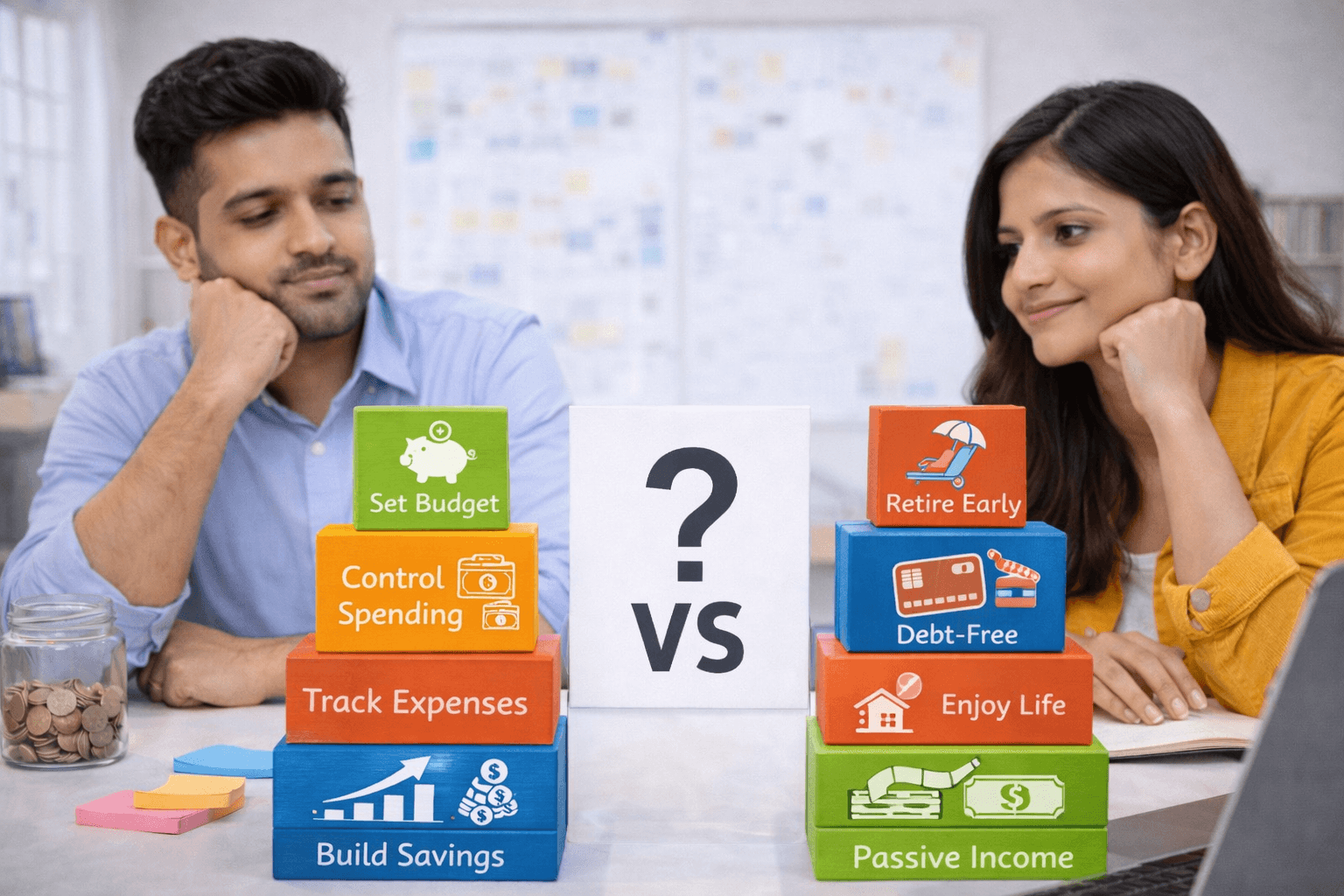

Financial Discipline vs Financial Freedom

Financial discipline and financial freedom are often misunderstood as opposites. In reality, financial discipline is the foundation that leads to financial freedom.

Financial discipline focuses on control and structure. Financial freedom represents choice and flexibility. Without discipline, freedom becomes unstable. With discipline, freedom becomes sustainable.

Financial discipline allows individuals to:

Reduce unnecessary debt

Increase savings reliability

Plan investments confidently

Achieve long-term goals

The path to financial freedom begins with disciplined financial behavior.

Financial Discipline and Smart Spending Habits

Spending decisions have the greatest daily impact on financial stability. Financial discipline helps control spending without removing enjoyment from life.

Smart spending habits supported by financial discipline include:

Prioritizing needs over wants

Avoiding impulse purchases

Evaluating value before spending

Aligning spending with goals

Resources like the Smart Spending Guide help individuals practice disciplined spending without feeling deprived.

How Financial Discipline Helps in Saving Money

Saving money consistently is difficult without financial discipline. Many people save occasionally but struggle to maintain the habit.

Financial discipline improves saving by promoting:

Saving consistency

Emergency fund creation

Financial self-control

Long-term financial stability

By treating savings as a priority rather than an afterthought, financial discipline transforms saving into a routine behavior.

Financial Discipline and Debt Reduction

Debt often grows when financial discipline is weak. Unplanned borrowing and emotional spending lead to repayment struggles.

Financial discipline supports debt reduction by:

Encouraging controlled spending

Preventing unnecessary borrowing

Improving repayment consistency

Reducing financial stress

Disciplined money management helps individuals regain control and move toward financial stability.

Tools That Help Maintain Financial Discipline

Maintaining financial discipline becomes easier with the right tools and systems. These tools reduce reliance on willpower alone.

Helpful tools include:

Budgeting apps

Expense tracking systems

Automated savings

Financial planning worksheets

Investment planning resources

Programs like the Money Mastery Program and Investment Planning Course provide structured guidance to strengthen financial discipline.

Financial Discipline and Emotional Control

Money decisions are often influenced by emotions such as stress, excitement, or pressure. Financial discipline introduces pause and reflection before action.

It helps individuals:

Reduce emotional spending

Improve financial self-control

Make rational money choices

Stay aligned with goals

Strong financial discipline leads to healthier financial behavior and improved confidence.

How Long Does It Take to Build Financial Discipline

Financial discipline is not built in a fixed timeline. It develops gradually through repetition and awareness.

Most people notice improvement when they:

Practice disciplined habits consistently

Track progress regularly

Adjust behavior consciously

Over time, disciplined financial behavior becomes automatic and sustainable.

Financial Discipline and Financial Independence

Financial independence is achieved when money supports life choices rather than limiting them. Financial discipline creates the structure needed to reach that stage.

It supports independence by:

Strengthening saving habits

Encouraging long-term planning

Reducing unnecessary risks

Supporting stable income management

Disciplined money habits make financial independence achievable rather than aspirational.

Conclusion

Financial discipline is the foundation of financial stability, confidence, and long-term success. It shapes how money is earned, spent, saved, and invested. By practicing financial discipline daily, individuals gain control over their finances instead of reacting to circumstances. Over time, this discipline leads to reduced stress, improved financial health, and greater freedom. Financial discipline is not restrictive. It is empowering when practiced with clarity and consistency.

If you want guided support to strengthen your financial discipline, you can explore Money Management Basics or Get in Touch to begin building a healthier financial future.

FAQ

1. What is financial discipline?

Financial discipline is the ability to manage money responsibly through consistent and controlled financial habits.

2. Why is financial discipline important?

It helps reduce financial stress, improve savings, and support long-term financial goals.

3. How can beginners practice financial discipline?

By tracking expenses, setting budgets, and practicing consistent saving habits.

4. What are the best habits for financial discipline?

Budgeting, disciplined spending, saving consistency, and regular financial reviews.

5. How does financial discipline help in saving money?

It ensures savings are prioritized and maintained consistently.

6. Can financial discipline reduce financial stress?

Yes, disciplined money management creates clarity and stability.

7. How long does it take to build financial discipline?

It varies, but consistent practice leads to noticeable improvement over time.

8. What tools help maintain financial discipline?

Budgeting tools, savings automation, and financial planning programs.

9. How does financial discipline support long-term goals?

It aligns daily money decisions with future objectives.

10. Can financial discipline lead to financial freedom?

Yes, financial discipline is a key driver of sustainable financial freedom.

Financial discipline is one of the most overlooked yet powerful habits when it comes to managing money effectively. Many people earn well but still struggle with savings, debt, and financial stress because they lack consistent money control. Understanding financial discipline and learning how to practice it can completely change how you handle income, expenses, and long-term goals.

Financial discipline is not about avoiding enjoyment or living with constant restrictions. It is about developing control, clarity, and confidence around money decisions. When practiced correctly, financial discipline becomes a supportive system rather than a burden.

Why Financial Discipline Is Important in Life

Financial discipline plays a major role in creating stability and reducing uncertainty. Without it, money decisions are often driven by impulse, pressure, or short-term emotions.

Financial discipline is important because it helps you:

Control unnecessary spending

Maintain saving consistency

Avoid financial stress

Prepare for emergencies

Make smart financial decisions

People with strong financial discipline experience fewer money-related worries and are better prepared for life changes. This discipline creates a sense of security that impacts both personal and professional life.

How Financial Discipline Builds Long-Term Wealth

Long-term wealth is rarely built through sudden income jumps. It is built through steady habits practiced over time. Financial discipline ensures that good money behavior continues regardless of income level.

Financial discipline supports wealth creation by encouraging:

Consistent saving habits

Disciplined spending choices

Risk-aware spending

Long-term financial planning

Financial independence habits

When financial discipline becomes part of daily life, wealth building strategies work more effectively and sustainably.

How to Develop Financial Discipline Step by Step

Developing financial discipline does not require drastic changes overnight. Small, consistent actions create lasting results.

Steps to build financial discipline include:

Tracking expenses regularly

Setting clear financial goals

Creating spending limits

Practicing money accountability

Reviewing financial behavior monthly

Learning money management habits gradually leads to stronger financial responsibility and better decision-making over time.

Financial Discipline vs Financial Freedom

Financial discipline and financial freedom are often misunderstood as opposites. In reality, financial discipline is the foundation that leads to financial freedom.

Financial discipline focuses on control and structure. Financial freedom represents choice and flexibility. Without discipline, freedom becomes unstable. With discipline, freedom becomes sustainable.

Financial discipline allows individuals to:

Reduce unnecessary debt

Increase savings reliability

Plan investments confidently

Achieve long-term goals

The path to financial freedom begins with disciplined financial behavior.

Financial Discipline and Smart Spending Habits

Spending decisions have the greatest daily impact on financial stability. Financial discipline helps control spending without removing enjoyment from life.

Smart spending habits supported by financial discipline include:

Prioritizing needs over wants

Avoiding impulse purchases

Evaluating value before spending

Aligning spending with goals

Resources like the Smart Spending Guide help individuals practice disciplined spending without feeling deprived.

How Financial Discipline Helps in Saving Money

Saving money consistently is difficult without financial discipline. Many people save occasionally but struggle to maintain the habit.

Financial discipline improves saving by promoting:

Saving consistency

Emergency fund creation

Financial self-control

Long-term financial stability

By treating savings as a priority rather than an afterthought, financial discipline transforms saving into a routine behavior.

Financial Discipline and Debt Reduction

Debt often grows when financial discipline is weak. Unplanned borrowing and emotional spending lead to repayment struggles.

Financial discipline supports debt reduction by:

Encouraging controlled spending

Preventing unnecessary borrowing

Improving repayment consistency

Reducing financial stress

Disciplined money management helps individuals regain control and move toward financial stability.

Tools That Help Maintain Financial Discipline

Maintaining financial discipline becomes easier with the right tools and systems. These tools reduce reliance on willpower alone.

Helpful tools include:

Budgeting apps

Expense tracking systems

Automated savings

Financial planning worksheets

Investment planning resources

Programs like the Money Mastery Program and Investment Planning Course provide structured guidance to strengthen financial discipline.

Financial Discipline and Emotional Control

Money decisions are often influenced by emotions such as stress, excitement, or pressure. Financial discipline introduces pause and reflection before action.

It helps individuals:

Reduce emotional spending

Improve financial self-control

Make rational money choices

Stay aligned with goals

Strong financial discipline leads to healthier financial behavior and improved confidence.

How Long Does It Take to Build Financial Discipline

Financial discipline is not built in a fixed timeline. It develops gradually through repetition and awareness.

Most people notice improvement when they:

Practice disciplined habits consistently

Track progress regularly

Adjust behavior consciously

Over time, disciplined financial behavior becomes automatic and sustainable.

Financial Discipline and Financial Independence

Financial independence is achieved when money supports life choices rather than limiting them. Financial discipline creates the structure needed to reach that stage.

It supports independence by:

Strengthening saving habits

Encouraging long-term planning

Reducing unnecessary risks

Supporting stable income management

Disciplined money habits make financial independence achievable rather than aspirational.

Conclusion

Financial discipline is the foundation of financial stability, confidence, and long-term success. It shapes how money is earned, spent, saved, and invested. By practicing financial discipline daily, individuals gain control over their finances instead of reacting to circumstances. Over time, this discipline leads to reduced stress, improved financial health, and greater freedom. Financial discipline is not restrictive. It is empowering when practiced with clarity and consistency.

If you want guided support to strengthen your financial discipline, you can explore Money Management Basics or Get in Touch to begin building a healthier financial future.

FAQ

1. What is financial discipline?

Financial discipline is the ability to manage money responsibly through consistent and controlled financial habits.

2. Why is financial discipline important?

It helps reduce financial stress, improve savings, and support long-term financial goals.

3. How can beginners practice financial discipline?

By tracking expenses, setting budgets, and practicing consistent saving habits.

4. What are the best habits for financial discipline?

Budgeting, disciplined spending, saving consistency, and regular financial reviews.

5. How does financial discipline help in saving money?

It ensures savings are prioritized and maintained consistently.

6. Can financial discipline reduce financial stress?

Yes, disciplined money management creates clarity and stability.

7. How long does it take to build financial discipline?

It varies, but consistent practice leads to noticeable improvement over time.

8. What tools help maintain financial discipline?

Budgeting tools, savings automation, and financial planning programs.

9. How does financial discipline support long-term goals?

It aligns daily money decisions with future objectives.

10. Can financial discipline lead to financial freedom?

Yes, financial discipline is a key driver of sustainable financial freedom.

Financial discipline is one of the most overlooked yet powerful habits when it comes to managing money effectively. Many people earn well but still struggle with savings, debt, and financial stress because they lack consistent money control. Understanding financial discipline and learning how to practice it can completely change how you handle income, expenses, and long-term goals.

Financial discipline is not about avoiding enjoyment or living with constant restrictions. It is about developing control, clarity, and confidence around money decisions. When practiced correctly, financial discipline becomes a supportive system rather than a burden.

Why Financial Discipline Is Important in Life

Financial discipline plays a major role in creating stability and reducing uncertainty. Without it, money decisions are often driven by impulse, pressure, or short-term emotions.

Financial discipline is important because it helps you:

Control unnecessary spending

Maintain saving consistency

Avoid financial stress

Prepare for emergencies

Make smart financial decisions

People with strong financial discipline experience fewer money-related worries and are better prepared for life changes. This discipline creates a sense of security that impacts both personal and professional life.

How Financial Discipline Builds Long-Term Wealth

Long-term wealth is rarely built through sudden income jumps. It is built through steady habits practiced over time. Financial discipline ensures that good money behavior continues regardless of income level.

Financial discipline supports wealth creation by encouraging:

Consistent saving habits

Disciplined spending choices

Risk-aware spending

Long-term financial planning

Financial independence habits

When financial discipline becomes part of daily life, wealth building strategies work more effectively and sustainably.

How to Develop Financial Discipline Step by Step

Developing financial discipline does not require drastic changes overnight. Small, consistent actions create lasting results.

Steps to build financial discipline include:

Tracking expenses regularly

Setting clear financial goals

Creating spending limits

Practicing money accountability

Reviewing financial behavior monthly

Learning money management habits gradually leads to stronger financial responsibility and better decision-making over time.

Financial Discipline vs Financial Freedom

Financial discipline and financial freedom are often misunderstood as opposites. In reality, financial discipline is the foundation that leads to financial freedom.

Financial discipline focuses on control and structure. Financial freedom represents choice and flexibility. Without discipline, freedom becomes unstable. With discipline, freedom becomes sustainable.

Financial discipline allows individuals to:

Reduce unnecessary debt

Increase savings reliability

Plan investments confidently

Achieve long-term goals

The path to financial freedom begins with disciplined financial behavior.

Financial Discipline and Smart Spending Habits

Spending decisions have the greatest daily impact on financial stability. Financial discipline helps control spending without removing enjoyment from life.

Smart spending habits supported by financial discipline include:

Prioritizing needs over wants

Avoiding impulse purchases

Evaluating value before spending

Aligning spending with goals

Resources like the Smart Spending Guide help individuals practice disciplined spending without feeling deprived.

How Financial Discipline Helps in Saving Money

Saving money consistently is difficult without financial discipline. Many people save occasionally but struggle to maintain the habit.

Financial discipline improves saving by promoting:

Saving consistency

Emergency fund creation

Financial self-control

Long-term financial stability

By treating savings as a priority rather than an afterthought, financial discipline transforms saving into a routine behavior.

Financial Discipline and Debt Reduction

Debt often grows when financial discipline is weak. Unplanned borrowing and emotional spending lead to repayment struggles.

Financial discipline supports debt reduction by:

Encouraging controlled spending

Preventing unnecessary borrowing

Improving repayment consistency

Reducing financial stress

Disciplined money management helps individuals regain control and move toward financial stability.

Tools That Help Maintain Financial Discipline

Maintaining financial discipline becomes easier with the right tools and systems. These tools reduce reliance on willpower alone.

Helpful tools include:

Budgeting apps

Expense tracking systems

Automated savings

Financial planning worksheets

Investment planning resources

Programs like the Money Mastery Program and Investment Planning Course provide structured guidance to strengthen financial discipline.

Financial Discipline and Emotional Control

Money decisions are often influenced by emotions such as stress, excitement, or pressure. Financial discipline introduces pause and reflection before action.

It helps individuals:

Reduce emotional spending

Improve financial self-control

Make rational money choices

Stay aligned with goals

Strong financial discipline leads to healthier financial behavior and improved confidence.

How Long Does It Take to Build Financial Discipline

Financial discipline is not built in a fixed timeline. It develops gradually through repetition and awareness.

Most people notice improvement when they:

Practice disciplined habits consistently

Track progress regularly

Adjust behavior consciously

Over time, disciplined financial behavior becomes automatic and sustainable.

Financial Discipline and Financial Independence

Financial independence is achieved when money supports life choices rather than limiting them. Financial discipline creates the structure needed to reach that stage.

It supports independence by:

Strengthening saving habits

Encouraging long-term planning

Reducing unnecessary risks

Supporting stable income management

Disciplined money habits make financial independence achievable rather than aspirational.

Conclusion

Financial discipline is the foundation of financial stability, confidence, and long-term success. It shapes how money is earned, spent, saved, and invested. By practicing financial discipline daily, individuals gain control over their finances instead of reacting to circumstances. Over time, this discipline leads to reduced stress, improved financial health, and greater freedom. Financial discipline is not restrictive. It is empowering when practiced with clarity and consistency.

If you want guided support to strengthen your financial discipline, you can explore Money Management Basics or Get in Touch to begin building a healthier financial future.

FAQ

1. What is financial discipline?

Financial discipline is the ability to manage money responsibly through consistent and controlled financial habits.

2. Why is financial discipline important?

It helps reduce financial stress, improve savings, and support long-term financial goals.

3. How can beginners practice financial discipline?

By tracking expenses, setting budgets, and practicing consistent saving habits.

4. What are the best habits for financial discipline?

Budgeting, disciplined spending, saving consistency, and regular financial reviews.

5. How does financial discipline help in saving money?

It ensures savings are prioritized and maintained consistently.

6. Can financial discipline reduce financial stress?

Yes, disciplined money management creates clarity and stability.

7. How long does it take to build financial discipline?

It varies, but consistent practice leads to noticeable improvement over time.

8. What tools help maintain financial discipline?

Budgeting tools, savings automation, and financial planning programs.

9. How does financial discipline support long-term goals?

It aligns daily money decisions with future objectives.

10. Can financial discipline lead to financial freedom?

Yes, financial discipline is a key driver of sustainable financial freedom.

© Copyright 2025

© Copyright 2025

© Copyright 2025